Software

Latest about Software

-

-

Microsoft just killed Windows’ most dreaded feature — the nightmare is getting a dream makeover

By Luke James Published

-

Sick of YouTube ads? I've got a few tricks that might help get rid of them

By Chris Stobing Published

-

Just like many Windows 10 users, some SSDs are snubbing Windows 11 too

By Madeline Ricchiuto Published

-

Windows Outlook is a nightmare right now, but there’s a weirdly simple fix

By Mahnoor Faisal Published

-

Banking Trojans have hit millions of Android devices in 2025 — here are the biggest threats and how to protect yourself

By Sean Riley Published

-

NordVPN CEO upends a common assumption about VPN servers: It's "basically not very true."

By Chris Stobing Published

-

How to enable and use Telnet on Windows 11

By Bryan Clark Last updated

-

Explore Software

Antivirus & Cyber-security

-

-

Sick of YouTube ads? I've got a few tricks that might help get rid of them

By Chris Stobing Published

-

Banking Trojans have hit millions of Android devices in 2025 — here are the biggest threats and how to protect yourself

By Sean Riley Published

-

NordVPN CEO upends a common assumption about VPN servers: It's "basically not very true."

By Chris Stobing Published

-

A new kind of phishing attack is fooling Gmail’s security. Here’s how it works

By Oscar Gonzalez Published

-

Best authenticator apps to stay safe online

By Monica J. White Last updated

-

Best VPN services in 2025: 5 VPNs I recommend, including a free option

By Rael Hornby Last updated

-

TP-Link routers may face nationwide ban after 'significantly alarming' link to US cyberattacks

By Rael Hornby Published

-

You need a VPN for school, here are 3 services we recommend

By Rael Hornby Published

-

'You basically have to throw your computer away': Researchers explain AMD 'Sinkclose' vulnerability, but do you need to worry?

By Madeline Ricchiuto Published

-

Browsers & Search Engines

-

-

Google released a critical Chrome update today -- you must update by June 5

By Chris Stobing Published

-

AT YOUR SERVICE?

AT YOUR SERVICE?Opera’s futuristic browser from 2017 returns as an agentic AI that will write code for you

By Mahnoor Faisal Published

-

Why I ditched Google Chrome for Microsoft Edge (and haven't looked back)

By Jowi Morales Published

-

Microsoft doesn't want to tell you how to uninstall Microsft Edge

By Oscar Gonzalez Published

-

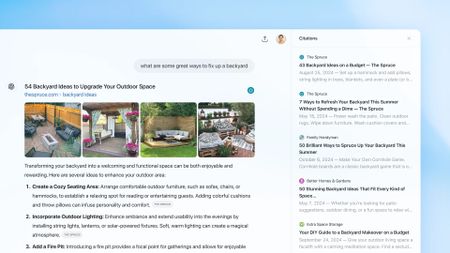

There are now 3 great reasons to switch from Google Search to ChatGPT Search

By Rael Hornby Published

-

Opera's Air browser wants to be the antidote to doomscrolling — but does it actually work?

By Rael Hornby Published

-

Top Google Chrome alternative for mobile arrives on Android

By Rael Hornby Published

-

How to use OpenAI's new ChatGPT search engine

By Sarah Chaney Published

-

How to clear cache in Google Chrome: This might improve the performance of your browser

By Rami Tabari Published

-

Creative & Media Apps

-

-

Photoshop on iPhone is finally here — it has one unexpected feature, too

By James Pero Published

-

Instagram, Facebook, and Messenger are down: Everything you need to know about Meta's outage

By James Pero Last updated

-

Best education apps for students

By Claire Tabari Published

-

Save over $350 with 50% off Adobe Creative Cloud

By Madeline Ricchiuto Published

-

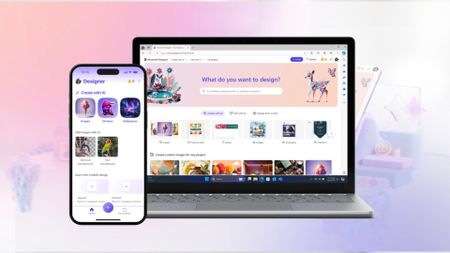

Microsoft brings controversial AI app to iPhone and Android devices

By Rael Hornby Published

-

This Google Photos AI upgrade will make finding any photo in your library a snap

By Sarah Chaney Published

-

Huawei announces launch of GoPaint tablet drawing app

By Sponsored Published

SPONSORED -

How to see your Spotify Wrapped 2023 and share your most-played songs

By Sarah Chaney Published

-

Cross-platform messaging is coming to WhatsApp: Here’s what we know

By Mark Anthony Ramirez Published

-

Work & Collaboration Tools

-

-

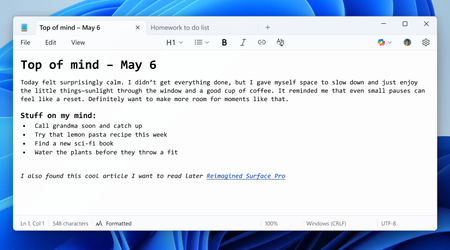

I found an app that connects all my apps — without trying to replace them. It's a life-changer.

By Jon Martindale Published

-

Intel Thunderbolt Share: The powerful PC-to-PC connection software is frustratingly elusive, but you don't need a new laptop to use it

By Ross Rubin Published

-

Top 5 Dell UltraSharp monitor deals: Save up to $300 on the ultimate productivity monitor!

By Stevie Bonifield Published

-

Logitech MX Creative Console review: Is this alternative stream deck a creative game changer?

By Stevie Bonifield Published

-

How to combine PDFs — merge your files into one document for free

By Sarah Chaney Last updated

-

Google Reverse Image Search: How to search with an image in Google

By Sarah Chaney Published

-

What is Proton Docs? Why you might want to give the privacy-focused Google competitor a chance

By Sarah Chaney Published

-

How to convert PDF to JPG, PNG, or TIFF

By Sarah Chaney Published

-

How to add Outlook Calendar to Google Calendar

By Sarah Chaney Published

-