Why is it so hard to find a GPU in 2021?

The pandemic isn’t helping PC builders find GPUs

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

You are now subscribed

Your newsletter sign-up was successful

Building a PC has never been this difficult. Starting in 2020, and extending into 2021, those attempting to buy a custom-built PC, or to build one themselves, are feeling the pinch of widespread unavailability of new graphics cards. Those lucky enough to find new cards are faced with an impossible decision: wait and hope the market improves, or fork over much more than the typical retail price to build now. And if you're looking for relief by buying second hand, don't count on cheaper prices. On eBay right now, you can expect to pay two-to-three times the retail price of a new card for most older, used models.

So what gives? How did we find ourselves in a situation where a GPU could double or triple the price of your build?

Global Supply Chain Issues

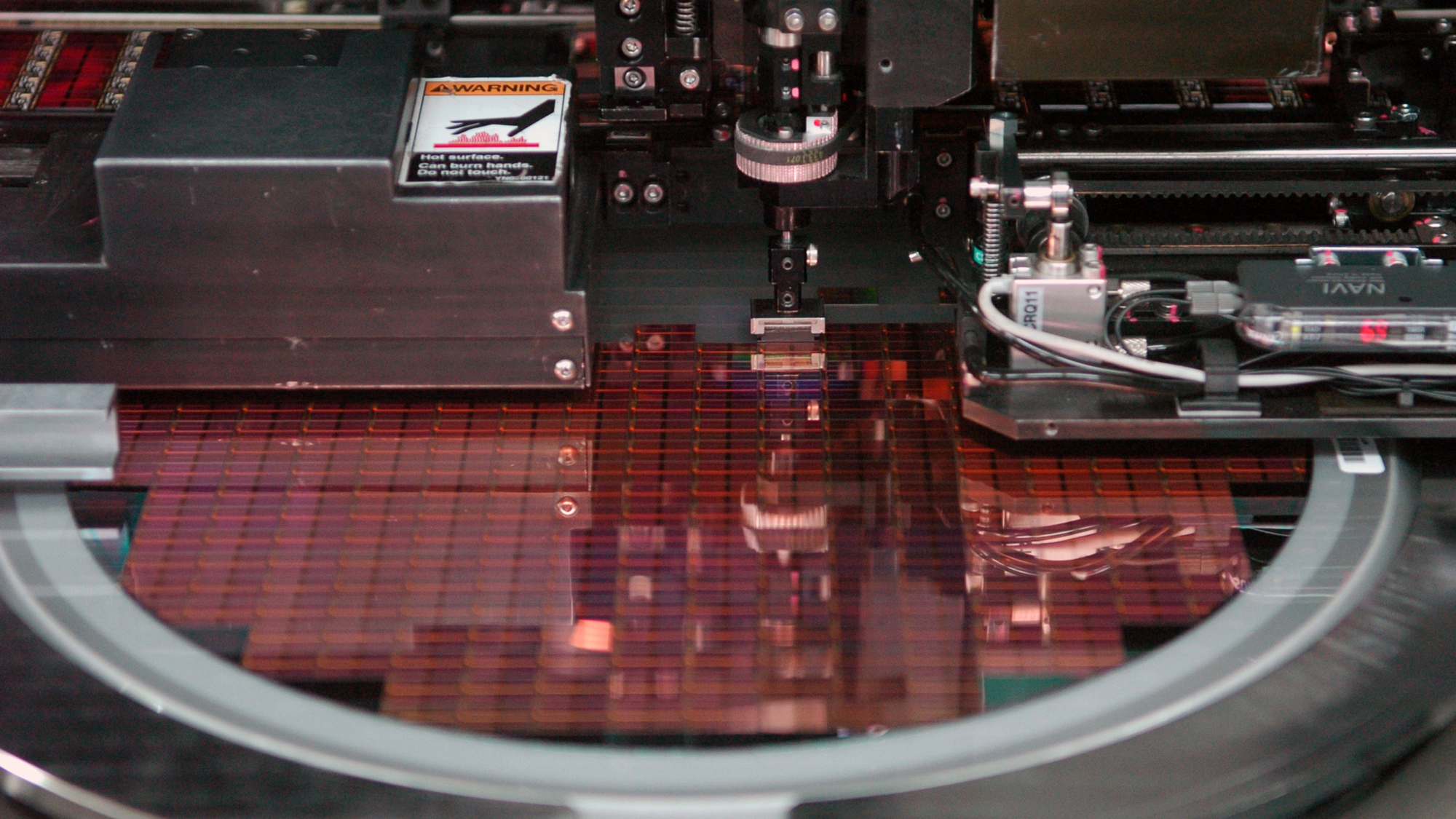

A graphics card is nothing without the silicon chip inside of it. Think of these chips as the brain of the GPU, a mini computer inside of your hardware. Before you can plug in that shiny new PC graphics card, companies like Nvidia and AMD need semiconductors to make them. And while you rely on Nvidia and AMD for graphics performance, they rely on companies like Samsung to produce the silicon. Due to a global shortage of silicon chips, Nvidia and AMD can't get the job done fast enough to meet demand.

With a global pandemic, the world's largest semiconductor manufacturers were forced to slow production considerably, and stop it altogether at times. Slowdowns in production, coupled with a rise in demand as people found themselves stuck inside and looking to upgrade or build new gaming or production rigs has left us in a bit of a bind when it comes to sourcing parts.

It's a problem that isn't unique to PC builders. Mobile phones, like Apple's iPhone 12, faced delays due to concerns of stock availability. Console gamers are still waiting to get their hands on a PS5 or Xbox Series X due to supply chain issues, specifically in sourcing the graphics cards these next-gen consoles rely on.

Scalpers

If supply chain issues weren't bad enough, scalpers are making all of our lives more difficult by buying entire inventories of these cards and selling them for huge profits to hardware-hungry consumers.

By buying up inventory -- either in the store or by using bots to snag available GPUs as they appear online -- scalpers control the supply and can artificially inflate demand. This, as we're seeing now, drives prices into the stratosphere. The secondary market is loaded with GPUs selling at two or three times their original retail price (for used hardware). New GPUs are either unavailable or being bought and resold on sites like eBay, Craigslist, and Facebook marketplace for hundreds, even thousands more than their suggested retail price.

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

Some retail stores have put systems in place that aim to curb this behavior by limiting purchases to one item per person. Every little bit helps, but sophisticated scalpers can always skirt the system with multiple user accounts and large networks of people who work together to source inventory and share profits.

Cryptocurrency Miners

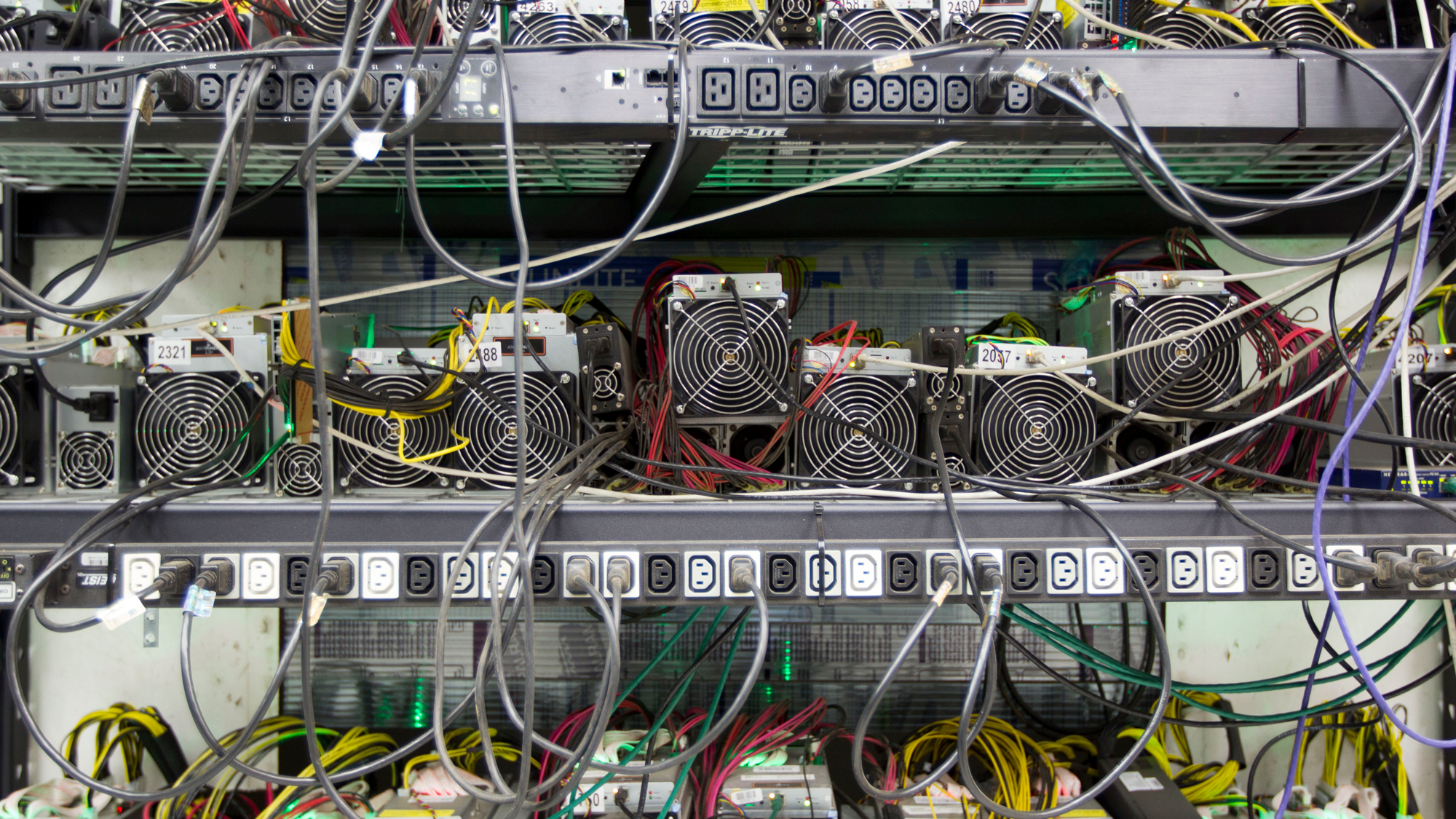

Last, but certainly not least, are cryptocurrency miners. We've seen this before. In the 2017 cryptocurrency gold rush, Bitcoin neared a then-record price of $20,000, leading to massive spikes in GPU purchases by those looking to mine cryptocurrency rather than buy it. Shortly after, Bitcoin tanked, leaving the cryptocurrency market in shambles and fueling a widespread sell-off of these GPUs in secondary markets.

History, as it often does, is repeating itself. Bitcoin, this year, has been on a tear, exceeding $60,000 at one point. This has fueled interest in a segment that's loaded with alt coins, each of which has been riding a similar wave of success. Cryptocurrency miners are, once again, interested in the space and buying up GPUs to turn hardware into mining rigs in hopes of striking it rich.

These rigs work by utilizing the power of a GPU to solve complex mathematical algorithms that are meant to secure a cryptocurrency network. Once a problem is solved, miners are rewarded with cryptocurrency for their troubles. These rigs typically rely on multiple GPUs to increase the rate at which they can solve these algorithms, thereby securing bigger rewards.

Nvidia, this year, made an attempt to thwart miners by blocking cryptocurrency mining on its RTX 3060 graphics card, but the strategy failed after it released a driver that re-enabled its mining capacity.

Until the cryptocurrency market reaches its next bear market, it's unlikely we'll see a decrease in demand for GPUs from cryptocurrency miners. But when it does, expect a flood of cheap cards onto secondary markets, each of which will be mostly worthless after being run at their max processing limit.

When will it end?

Let's start with the good news. Nvidia and AMD both report that they're back to pre-pandemic production levels. This is undoubtedly a good thing.

Now for the bad. While production is back to pre-pandemic levels, demand is at an all-time high. Nvidia told The Verge that the GPU shortage is likely to continue through 2021, and into 2022.

That's not to say you won't find a GPU this year, but it's not going to be easy.

Bryan covers everything you need to know about Windows, social media, and the internet at large for Laptop Mag. Thanks to his extensive knowledge of operating systems and some of the most popular software out there, Bryan has written hundreds of helpful guides, including tips related to Windows 11 drivers, upgrading to a newer version of the OS, editing in Microsoft Photos, or rearranging pages in Google Docs.