Affirm Launches, New Mobile Payment Startup from PayPal Co-Founder

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

You are now subscribed

Your newsletter sign-up was successful

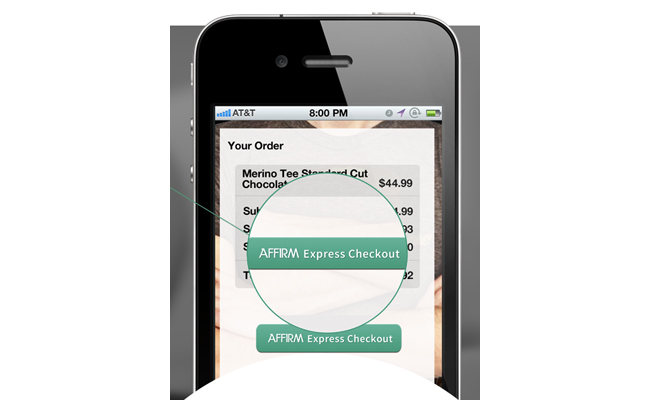

How many times have you tried to order something online using your smartphone only to get frustrated and end up waiting till you're in front of your laptop at home to do it? When you get home, maybe you remember to order the item or maybe you don't. Those decisions mean little to you, but to the merchant, it's a lost sale. A newly launched startup, Affirm, hopes to make mobile payments easier and more seamless.

Affirm is the brainchild of PayPal co-founder Max Levchin, a tech entrepreneur who successfully sold PayPal to eBay and another project, Slide, to Google. The profit from the later provides the funding for his Hard, Valuable, Fun tech incubator. Affirm is the first project the incubator launched.

So just what does Affirm do that makes mobile payments easier? It acts as a charge card that users pay back at the end of the month, more like an American Express charge card, than a credit card. The service is free to consumers but makes it money from merchant fees, but, ideally, lowers the rate of forgotten mobile transactions.

Affirm's first merchant partner is 1-800-Flowers. Affirm guarantees payment to merchants, because they won't necessarily extend their credit to everyone. Instead of a traditional credit check, Affirm uses Facebook for user authentication and other signifiers such as zip code to determine the likeliness that they will be repaid within 30 days. It's an interesting system, though as All Things D points out, the use of Facebook could open up a whole other can of privacy worms.

The mobile payments space is certainly crowded right now, but Affirm just might be the link to help smaller companies process mobile transactions more easily.

via All Things D and image via GigaOm

- Top 10 iPhone Alternatives

- How to Fix Mobile Payments

- Astro Turns Any iPad or iPhone into a Feature Filled POS System

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.