What separates a $1,000 iPhone from a $3,500 one? About 7,000 miles.

Analyst claims U.S. tariffs may cause your next iPhone to triple in price.

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

You are now subscribed

Your newsletter sign-up was successful

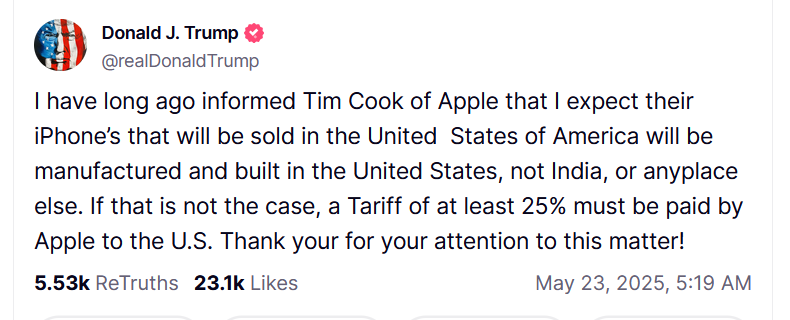

On Friday, U.S. President Donald Trump took to his Truth Social network to condemn Apple’s practices of offshoring jobs to China to manufacture the iPhone and other products in its device lineup.

After threatening an individual tariff of 25% on all Apple products, some analysts are already putting in predictions for how the President’s proposed rate could affect Cupertino’s supply chain, and ultimately what the company would need to charge for products like the iPhone, MacBooks, and more if those threats are made real.

Trump threatens a 25% hike on Apple products

For starters, here is some context on what it looks like when a country tries to apply individual tariffs to companies or sectors attempting to reshore.

What Trump is suggesting, at least broadly, wouldn’t be the first time a government has applied tariffs to a single corporation.

Throughout history, the U.S. has placed tariffs on everything from Chinese-made solar panels to Canadian lumber to protect and ensure the growth trajectory of domestic competitors.

However it is the first time a president has threatened a domestic U.S. company with tariffs for goods it produces overseas.

“I have long ago informed Tim Cook of Apple that I expect their iPhones that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else,” Trump posted to Truth Social on Friday morning.

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

“If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S.”

The fact that no one has ever tried to do something like this before acknowledges just how unprecedented Trump’s threats are.

Some economists say it is damaging to the U.S. consumer and stock market.

As Apple produces nearly 90% of its entire product stack from within China’s borders, this clearly presents a problem for the company.

In February of this year, Tim Cook made loose promises that Apple plans to restore over $500 billion worth of manufacturing to the US over the next four years.

This timeline feels suspiciously convenient on its own, but Trump has decided to put even more pressure on Cupertino to bring jobs back home nonetheless.

What are analysts saying about next steps?

Ahead of Trump’s latest amendment to global trade policy, Dan Ives, global lead of technology research at financial services firm Wedbush Securities, told CNN in April that bringing iPhone manufacturing back to the U.S. wasn’t much more than “a fictional tale.”

“You build that (supply chain) in the U.S. with a fab in West Virginia and New Jersey. They’ll be $3,500 iPhones,” he said.

Ives also addressed the sheer logistical nightmare, saying it would take more than three years and $30 billion just to get 10% of the supply chain back to US shores.

Whether a tariff or the cost of reshoring is applied, the end result is a more expensive iPhone, MacBook, iMac, or Vision Pro for you or someone in your family going forward.

Would you even want a U.S.-made iPhone?

If there’s one tech story that points to the potential pitfalls of Trump’s overall strategy for the U.S. tech industry, it’s Intel.

Over the past half decade, the company has lost almost 65% of its total value, a decrease driven by AMD’s surprise chiplet attack, which threw one of America’s most stable blue chip stocks into abrupt, and up to now seemingly unending, chaos.

AMD had spent the better part of its history trailing Intel in sales, innovation, performance, and reliability. However, the company’s growing partnership with Taiwan’s chip fab specialists, Taiwan Semiconductor Manufacturing Company, or TSMC, created a new attack point.

One where the engineering, programming, and design of a chip could be handled stateside, while TSMC would shoulder the actual chip fabrication.

A split set of duties allows companies like AMD or Nvidia to offshore many of the dirtier, more heavily regulated parts of producing chips to other regions, while hiring talent willing to work in buildings not attached to silicon manufacturing floors in the United States.

Meanwhile, Intel continued to expand domestic fabrication in places like Oregon, Arizona, Nevada, and others for years before the CHIPS Act was even a thing.

Famously, the company stumbled significantly from the 10nm to 7nm production process (to the tune of billions of dollars). AMD eventually seized its opportunity to close the gap between the two chipmakers.

Everyone else is doing it, so why can’t Apple?

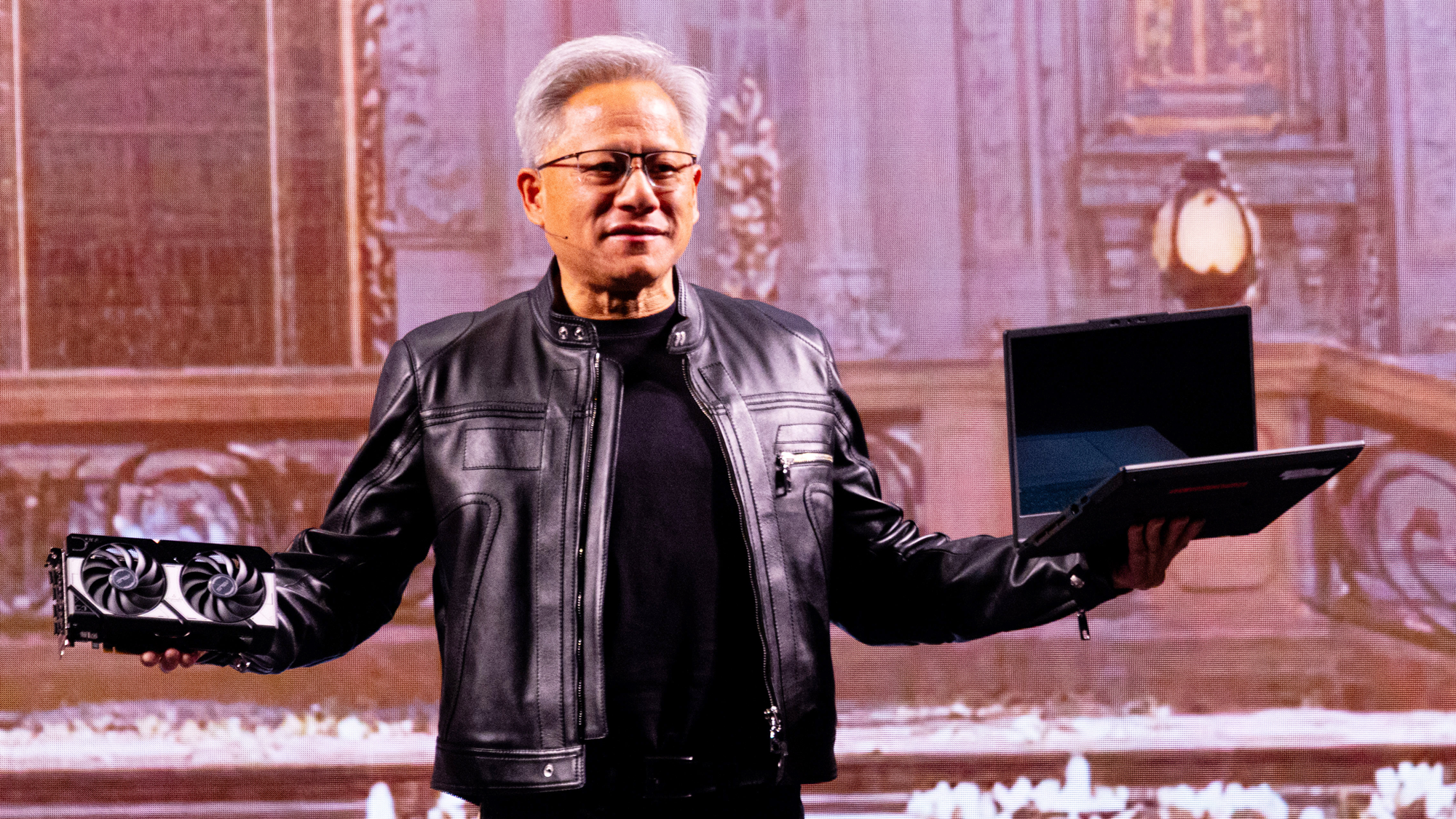

AMD’s model isn’t unique, of course. Nvidia, Apple, and even a modernized Intel all have to rely heavily, if not entirely, on Taiwan and TSMC to manufacture a significant portion of the chips backed by their engineering and design efforts.

Designing a product in the U.S. and manufacturing it abroad has become a core component of the NAFTA-driven economic model since Clinton first passed the bill in the 90s. As such, it’s almost strange for Apple to be singled out the way it has been, considering how many of its direct competitors do the exact same thing.

In all likelihood, Trump, who famously said “everything’s computer," is no expert on technology trade. This lack of awareness likely allows underdogs like AMD, and even more confusing tech prospects like Nvidia, to fly under the 78-year-old’s radar in what’s become the status quo for any Silicon Valley company that wants to keep the lights on these days.

Currently, the only company seemingly capable of usurping Apple’s claim to the number one most valuable company is Nvidia, another tech giant that’s doing the exact same thing Trump claims to be against.

However, one thing Apple doesn’t have that Nvidia does is the backing of everyone around them. What’s suitable for Nvidia is good for the world (or the U.S.). So even rivals like Meta, Tesla, and Amazon still line up next to one another to sing the hardware maker’s praises.

At the same time, they also commit to a competing AI arms race of biblical proportions against each other.

Whether Apple’s 25% tariff is real, enforceable, or something Trump will even care about next week is likely a whim left to the courts and whatever Fox News complained about last night.

But if the company does get stuck with a new sticker price, it could face even fiercer competition from rivals like Samsung and lose shares to domestic winners like AMD, Intel, and Nvidia, which are just as complicit in offshoring US manufacturing as Apple but still somehow manage to escape Trump’s ire.

More from Laptop Mag

Chris Stobing grew up in the heart of Silicon Valley and has been involved with technology since the 1990s. Previously at PCMag, I was a hardware analyst benchmarking and reviewing consumer gadgets and PC hardware such as desktop processors, GPUs, monitors, and internal storage.

He's also worked as a freelancer for Gadget Review, VPN.com, and Digital Trends, wading through seas of hardware and software at every turn. In his free time, you’ll find Chris shredding the slopes on his snowboard in the Rocky Mountains where he lives, or using his culinary-degree skills to whip up a dish in the kitchen for friends.