Tariffs and TSMC delays could turn Apple into an Intel Foundry customer

Intel's external production is currently "not significant," but that is expected to change by 2027

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

You are now subscribed

Your newsletter sign-up was successful

Intel has historically downplayed its external Foundry customers, but on Tuesday, CFO David Zinsner gave us some insight into why Intel remains silent on its biggest clients.

During a conversation at the J.P. Morgan Global Technology, Media, and Communications conference in Boston, Zinsner confirmed that Intel doesn't have a significant volume of external chips. At least on the 18A process node. Zinsner implied Intel will have more customers for its future 14A process node.

"We have the traditional pipeline modeling, we have a bunch of potential customers, and then we get test chips, and then some customers fall out of the test chips. And there's a certain amount of customers that hang in there. So committed volume is not significant right now," Zinsner said.

Zinsner has been at Intel since 2022 and was at Micron before that. Before Lip-Bu Tan took over as CEO in March, Zinsner served as co-CEO with fellow Intel executive MJ Johnston Holthaus after Pat Gelsinger stepped down as CEO in December 2024.

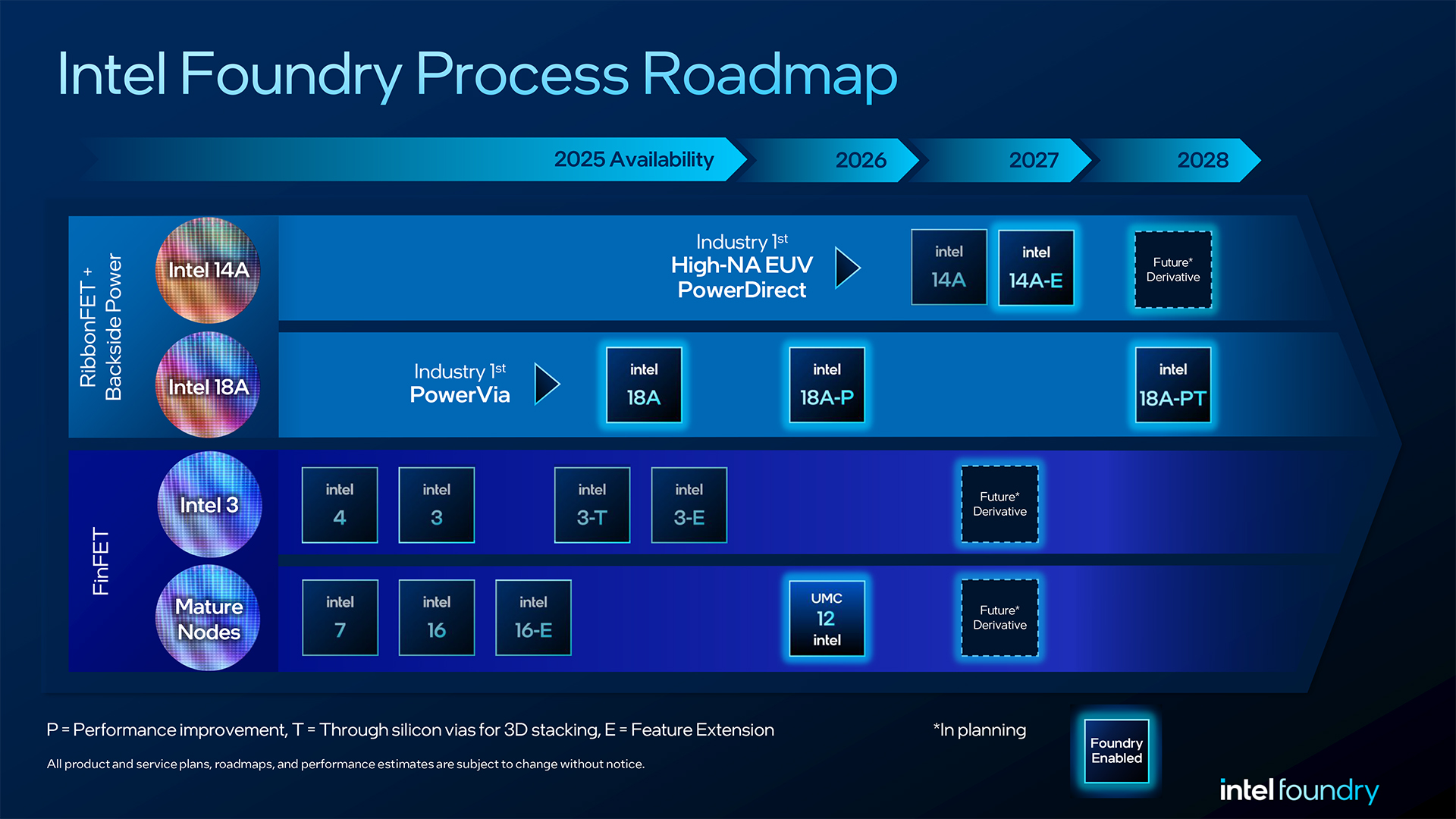

Intel Foundry is currently working on the 18A and 14A production pipelines for chips in the 2 nm-and-under range, these processes will be used for Intel's own chips. The first, codenamed Panther Lake, will arrive later this year, Zinsner confirmed.

"We always expected that the predominant amount of volume of 18A was going to be internal to us, and we would win customers here or there that would fill in the gaps." However, Intel will be looking for a higher volume of external sales for 14A.

So, while Intel may not be making many chips for outside customers right now, a recent report from SemiAccurate indicates that could change soon.

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

Let's take a closer look at what could be in store for Intel's chip foundry business.

Intel Foundry's existing customers

So far, a few big names have been reported as Intel Foundry clients.

Reuters and SemiAccurate have previously reported that Broadcom and Nvidia are Intel Foundry customers, and Taiwan Semiconductor could potentially pitch a change to Intel to its longtime customers. According to that same Reuters report, TSMC also pitched Intel Foundry to AMD, but there has been no further news on that front.

Reuters has also reported on a deal between Intel Foundry and Amazon to make a custom chip.

One of the few official confirmed partners with Intel Foundry is Microsoft, which announced a partnership with Intel Foundry in February of last year.

While not all of these rumors and deals have been confirmed, they do indicate a potential shift in the silicon production market, which lends some credence to SemiAccurate's most recent report on Intel Foundry.

This new report, published on Monday, implies that Apple might be the newest Foundry customer as TSMC, Apple's current production partner, is capacity-bound on advanced packaging.

Lenovo's Early Memorial Day Access sale knocks $256 off the 2024 Lenovo IdeaPad 5i 2-in-1 laptop with coupon "DEASAVINGS1". Get things done from anywhere and enjoy seamless performance, whether working on a college term paper, drafting documents for work, or consuming content in your downtime. Key specs: 14-inch FHD (1920 x 1080) 300-nit touchscreen, Intel Core 5 120U 10-core CPU, 8GB RAM, Integrated Intel Graphics, 512GB SSD, 720p webcam with dual microphone and privacy shutter, fingerprint reader, Lenovo Digital Pen, Windows 11 Home

Intel's external foundry production is "not significant" right now, but it could be in the future

A direct read Zinsner's comments implies that many of Intel's external Foundry customers have yet to fully switch production lines for their chips.

However, it's possible that those external custom chips are still in testing or that the exact details of the agreement are still being negotiated.

After all, Zinsner did indicate that most of Intel Foundry's 18A process would be sold internally to Intel, while 14A is expected to have a broader range of external wafer sales.

But if the rumors of TSMC's maxed capacity are true, combined with the ever-shifting US foreign manufacturing tariffs, Intel Foundry could be a more attractive option than ever for silicon production.

TSMC is not out of the chip game yet, though. It's reportedly working on 2nm and smaller silicon wafers, which are expected to be used in the next generations of Apple Silicon.

So, even if a company like Nvidia or Apple were to shift production from TSMC to Intel Foundry, we likely wouldn't see those chips for a few generations. That's in line with Zisner's comments on Tuesday about Foundry production. Intel's 14A process is expected to hit commercial production in 2027, which is also when Intel Foundry is set to break even.

This could potentially be thanks to external customers. And that would coincide with the next big Nvidia (RTX 60-series) or Apple Silicon (M7) launches.

Intel has been keeping its Foundry cards close to its chest for years, so we'll likely only know the details once the chips are ready for production or agreements have been filed with the SEC.

More from Laptop Mag

A former lab gremlin for Tom's Guide, Laptop Mag, Tom's Hardware, and TechRadar; Madeline has escaped the labs to join Laptop Mag as a Staff Writer. With over a decade of experience writing about tech and gaming, she may actually know a thing or two. Sometimes. When she isn't writing about the latest laptops and AI software, Madeline likes to throw herself into the ocean as a PADI scuba diving instructor and underwater photography enthusiast.