7 Killer Kickstarter Alternatives

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

You are now subscribed

Your newsletter sign-up was successful

Crowdfunding has quickly become the lifeblood for inventors and start-ups around the world. Services such as Kickstarter connect up-and-coming entrepreneurs who have a product they want to bring to market with donors who, in turn, are given either the product being developed or simple gifts such as T-shirts or tote bags. But a new group of crowdfunding services are looking to make a splash of their own.

Companies like Christie Street are working to add more accountability to the crowdfunding experience by thoroughly vetting entrepreneurs before they can seek investors. Still others are helping business start-ups get off the ground by letting investors donate money in exchange for a reward or a stake in the fledgling business. So if you’re looking to raise some cash for a new invention, or help bankroll a start-up, these are the services to check out.

1. Christie Street

Established: 2012

Home Base: Santa Monica, Calif.

Designed to help inventors get their products into the hands of the masses, Christie Street raises funds for products through pre-purchases. The service, which is taking on Kickstarter directly, protects investors by vetting inventors and entrepreneurs before putting anything up for sale. To do so, Christie Street requires that inventors submit designs for their product, provide a unit-cost calculation, agree to third-party factory audits, trademark their products and allow Christie Street to keep any raised funds in an escrow account.

“We believe that by creating an ecosystem and community like this, over time, we’ll attract the best inventors, because the investors will be there to fund the best products,” said James Siminoff, Christie Street’s chief inventor.

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

One recent success made possible through Christie Street is DoorBot, a Wi-Fi video doorbell that connects to your tablet or smartphone. So far, inventors have raised nearly $500,000 through Christie Street. The service’s profits come from a 5 percent fee charged to inventors if they raise their funding goal. If their goal isn’t reached, investors get their money back and the inventors aren’t charged a dime.

More: Top 8 Kickstarter Gadgets

2. CircleUp

Established: 2012

Home Base: San Francisco, Calif.

Firmly targeting the consumer and retail product market, CircleUp helps entrepreneurs working on marketing physical products get in touch with investors. That said, the service currently limits financial backers to accredited lenders only, those with a net worth of more than $1 million. In fact, Procter & Gamble recently teamed up with the service hoping to connect with beauty and personal care start-ups.

As CircleUp’s Investor Executive Megan Zito explained it, “We are an equity site, so you become a direct shareholder in the product that is created.” According to Zito, the retail product market is difficult for entrepreneurs to crack, as there are fewer options available to them. “They can’t get in touch with venture capital and angel funding.”

So far, 10 companies have closed their funding rounds using CircleUp since the service launched in April 2012, including Rhythm Superfoods and Episencial Skincare. Companies that raise funds through CircleUp are required to pay a percentage of the total raised to CircleUp’s financial services firm, WR Hambrecht + Co. Investors don’t have to pay a thing.

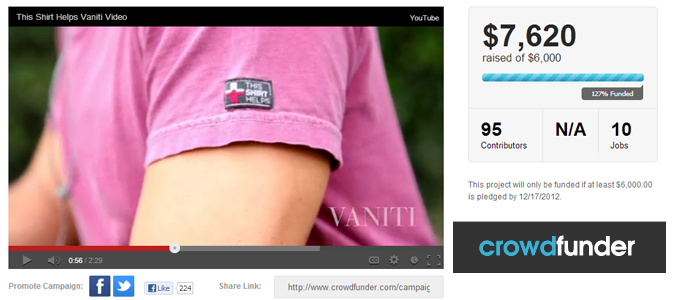

3. Crowdfunder

Established: 2011

Home Base: Los Angeles, Calif.

Crowdfunder has been leading the charge in the crowdfunding space, seeking to ensure that all individuals can invest in start-up companies they find interesting. The service currently offers a Kickstarter-style donation model that allows start-ups to offer contributors specific rewards for donating a set amount of cash.

For example, the company LSTN (pronounced listen) successfully raised $6,000 in less than two weeks to fund a video promoting its line of headphones made of reclaimed wood. For every pair of headphones sold, the company provides a free hearing aid to needy children. As of yet, there is no cost for investors or businesses to use Crowdfunder.

More: 50 Cent Talks Headphones & Philanthropy

4. Fundable

Established: 2011

Home Base: Santa Monica, Calif.

California-based Fundable offers both the Kickstarter-style reward method to fundraising and an investment option, allowing entrepreneurs to seek funds through donations or selling stock in their companies. Fundable says the rewards option usually generates less than $50,000 for companies, while the investment method generates between $50,000 and $10 million.

“A lot of businesses come on our site to offer rewards and then move on to equity,” said Eric Corl, Fundable’s president and cofounder. What differentiates Fundable from the rest of the business crowdfunding services out there is that Corl and company actively work with their partner entrepreneurs. “We get on the phone with any client that would like to work with us. We have a team that will support you.”

Corl points to BodBot, which has developed a virtual personal trainer, as an example of Fundable’s success. Using Fundable’s rewards-based approach, the company raised $35,000 in less than two weeks, far more than its initial goal of $20,000 in eight weeks. Fundable’s investment-based service costs entrepreneurs a flat fee of $99 per month. Users of the rewards-based service are charged 3.5 percent of the total amount raised during the life of their campaigns.

5. Funding Circle

Established: 2010

Home Base: England

Creditworthy businesses operating in the U.K. can turn to Funding Circle as a means to get in touch with investors for loan opportunities. Investors and businesses join the service’s online auction where investors bid to offer businesses loans, cutting out the banking-system middlemen. A business then chooses the investor that offers the best loan terms. Loans available through Funding Circle are available at a fixed rate with term lengths of one, three and five years.

“We’ve had over 30,000 people registered with Funding Circle,” said David de Koning, head of communications. “We also have a number of institutional investors as well, including the British government, Lancashire County Council and Huddersfield University.” So far, Koning said, the company has helped British businesses borrow more than $120 million. Funding Circle charges investors a 1 percent annual fee based on the outstanding amount of their loans. Borrowers, meanwhile, are charged a percentage fee based on the term of their loan.

More: How Google+ Can Boost Your Business

6. SoMoLend

Established: 2011

Home Base: Cincinnati, Ohio

For investors interested in building businesses in their communities there’s SoMoLend, short for social, mobile, local lending. Small businesses seeking loans sign up to create a profile on SoMoLend’s website and fill out a loan application for anywhere between $100 and $1 million. The average loan request is less than $160,000. SoMoLend then provides investors with information on nearby businesses based on their GPS location, ensuring that lenders are connected with local businesses. If a business accepts an investor’s loan offer, the business gets the cash it needs and the lender gets the initial investment back plus interest.

Although it doesn’t currently charge users any fees, SoMoLend will eventually require a 4 percent orientation fee from borrowers and a 1.8 percent portfolio management fee from investors. Although SoMoLend only works with accredited investors, the company says it will allow peer-to-peer lending when the SEC’s Crowdfunding Act is put into effect. Businesses such as the Cincinnati-based Hyde Park Body Boutique have benefitted from the service by raising $9,000 to expand.

7. WeFunder

Established: 2012

Home Base: Cambridge, Mass.

The Massachusetts-based WeFunder is dedicated to helping start-up companies get on their feet. A former start-up itself, which got the backing of 58 investors, WeFunder wants to ensure that the average person can invest in a business he or she believes in once the Crowdfunding Act legislation is settled. WeFunder's cofounder and president, Michael Norman, said investors currently receive convertible notes, which turn into stocks at a later date. Part of the service’s draw is that it works with businesses to help filter comments from investors.

“The dynamic can’t be, ‘I have 100 to 200 investors that are constantly distracting me from building the business.’ There has to be a way the entrepreneur can build their company, but can get feedback from the investors that can work in a scalable way,” said Norman. To accomplish this, “investors proxy their voting rights to WeFunder, which acts on behalf of investors.”

For now, WeFunder only promotes one start-up per week, such as Microryza, which seeks to provide funding to science research. So far the company has raised approximately $162,000 for science initiatives that otherwise would be unable to get funding from big-name sources such as the National Institutes of Health. For its trouble, WeFunder gets a 5 to 8 percent cut of the total amount of money raised for entrepreneurs.