Digital Allowance Apps for Parents and Kids

The average American child receives $15 per week in allowance, whether it's through a debit card, cold hard cash or an iTunes account. That adds up to $780 per year, which is far from chump change for most families, but the benefits for teaching children about money can be worth it if they spend it wisely. So how you manage that money? Apps might be the answer for some.

The primary benefit of getting an allowance is "an understanding of financial responsibility," Hilary DeCesare, a digital parenting expert and cofounder/CEO of Everloop, an online social media network for kids under 13, said. "An allowance will teach [kids] to manage their own accounts and budget their spending. It is a need vs. want situation, and kids need to understand the difference."

DeCesare believes, like many others, that parents should monitor how their children are spending their allowance, especially when they're younger, to instill a sense of financial responsibility. While in the past parents might collect receipts to do this and review on a regular basis, the digital age has allowed a slew of apps to replace the paper. These apps let kids log exactly what they purchase and how much they spend, which the parents have access to and can discuss with their child. But do they work as they should?

There's a whole market of allowance apps out there, some of which offer the ability to put some of that allowance into savings or tucked away to donate to a charity. And some even integrate with chores: Say you complete two out of three of your chores for the day. The app will log a designated dollar amount for each chore.

MORE: High-Tech Shopping: Meet the Future of Retail

A+ Allowance is one such free iOS option, which integrates chores into the allowance equation. Parents assign a weekly allowance to each child, then choose the chores that child is expected to complete in order to earn their allowance. We appreciate this approach of teaching kids that they have to earn their money, sadly that's where the app functionality ends. Once a child checks off his chores it tells them the total they've earned, but doesn't offer any additional features.

Based on the $4.99 price tag, we expected great things from the iOS iAllowance app. Unfortunately, iAllowance was underwhelming. You can set up accounts for each of your kids, then allot a certain amount per week for spending, savings and charity. Parents can set chores for each child to complete every day, then kids can see how much of their allowance they're earning from completing each chore.

Sign up to receive The Snapshot, a free special dispatch from Laptop Mag, in your inbox.

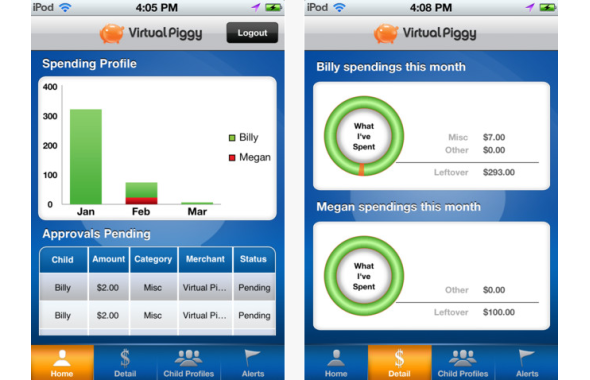

Another allowance app, VirtualPiggy offered more functionality. This free Android and iOS download lets parents see how their children are managing their allowance, with separate profile for parents and children. Parents can see everything their child buys, but only if the child has purchased something through one of the supported merchants. If their kid uses cash or their debit card to buy something at a store that's not supported, that financial info won't be logged.

While we were initially intrigued by this category, we were sadly disappointed that none of these apps offered bank integration. We appreciate the sentiment of VirtualPiggy, A+Allowance, iAllowance and several others we tested out. And we think these are good starting platforms for digitally managing an allowance. However, without bank integration or a way to accurately see exactly when physical money enters and leaves a child's hands, there's no real way of enforcing financial responsibility.