Sprint Spark vs. AT&T LTE: Which Network is Faster?

When Sprint unveiled its Spark network during a demo earlier this month, we saw mind-blowing data speeds of more than 50 Mbps for downloads-- but that was under the carrier’s ideal conditions in a lab. So we decided to put Sprint’s new tri-band LTE network to the test in the real world at couple testing sites in New York City.

The Samsung Galaxy Mega is one of four devices compatible with Sprint’s Spark network. The HTC One Max, Samsung Galaxy S4 Mini and LG G2 are also capable of taking advantage of Sprint’s enhanced network, which the carrier says is designed to improve bandwidth-intensive services. Using two different Samsung Galaxy Megas--one running on Sprint and the other using AT&T’s network--we ran the Speedtest.net app to see which carrier offers faster data speeds. We also timed how long it took to load websites to get a sense of which network performed faster in everyday use.

Editors' Note: We chose AT&T for this comparison because the carrier has identical hardware in the Galaxy Mega.

MORE: The Biggest Smartphones in the World

Lexington Ave. and 63rd St.

At our first testing site, we saw a noticeable difference in download and upload speeds between the two handsets. The Sprint-powered Samsung Galaxy Mega averaged 8.25 Mbps for download speeds and 6.87 Mbps for uploads. This download speed was about twice as fast as the Galaxy Mega running on AT&T’s network, which averaged 4.01 Mbps in the same location at the same time. The Sprint handset’s upload speeds were also about six times faster than the AT&T device’s average of 1.39 Mbps for uploads.

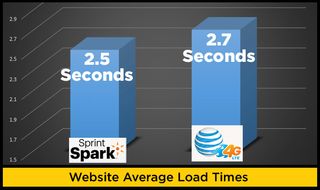

Although Sprint’s Spark network may have smoked AT&T’s in terms of download and upload speeds, there wasn’t much of a difference when it came to everyday Web browsing. The Galaxy Mega running on Sprint loaded CNN.com in 2.47 seconds, The New York Times w

ebsite in 1.91 seconds, ESPN.com in 3.56 seconds and Yahoo.com 2.31 seconds, averaging at 2.5 seconds.

The AT&T version was just slightly slower, as it took 3.86 seconds to load CNN.com, 2.01 seconds to load The New York Times website, 4.19 seconds to load ESPN.com and 2.79 seconds to load Yahoo.com, averaging at 3.21 seconds. This is less than a second slower than the Sprint handset’s average time when it comes to loading Web pages.

Stay in the know with Laptop Mag

Get our in-depth reviews, helpful tips, great deals, and the biggest news stories delivered to your inbox.

Lexington Ave. and 56th St.

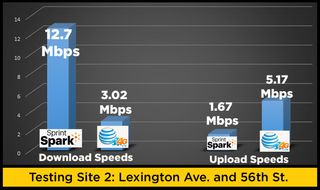

Although only a few blocks away, the results at our second testing site were significantly different than those from our previous location. Oddly enough, the Sprint Samsung Galaxy Mega offered fast download speeds but its upload speeds plummeted. The device averaged 12.7 Mbps down, but a weak 1.67 Mbps for uploads.

Meanwhile, the AT&T Galaxy Mega suffered from the opposite problem. Download speeds averaged a sluggish 3.02 Mbps, which is about four times slower than the Sprint device’s download speeds. However, data speeds picked up slightly to average 5.17 Mbps for uploads, making the AT&T handset about five times faster than the Sprint version in that regard.

Similar to the previous testing site, we saw minimal difference in terms of loading websites. But this time, the AT&T version proved to be slightly faster. The Sprint Galaxy Mega averaged 2.56 seconds, compared to Sprint's 2.28 seconds.

Available Spark Markets

Sprint is in the early stages of rolling out its Spark technology, which means you won't find it in many markets just yet. Sprint says that it plans to deploy Spark in 100 cities across the U.S. over the next three years, but for now the service is limited to five major cities. Spark can be found in certain areas of New York City, Los Angeles, Chicago, Tampa and Miami.

Outlook

Sprint’s Spark network is definitely speedy. During our testing Spark boasted download speeds that were twice as fast as AT&T's at our first location and three times as fast at our second site. There wasn't much of a difference when it came to loading websites, but you should see more of difference when downloading larger files like apps and videos.