Laptop Mag Verdict

The Classic hits all the right notes for BlackBerry diehards, with a comfortable keyboard and long endurance.

Pros

- +

Sturdy, attractive design

- +

Excellent keyboard

- +

Long battery life

Cons

- -

Limited app support

- -

Low-resolution display

Why you can trust Laptop Mag

Coke tried it. So did Apple with the iPod. Now BlackBerry is affixing the Classic moniker on its latest smartphone, and imbuing the device with all the features -- a great keyboard, excellent security and all-day battery life. Priced at $449 unlocked, this Classic is guaranteed to bring a smile to any executive or road warrior who has an affinity for all things BlackBerry. However, the device's popularity won't extend beyond the business set.

Design

What's old is new again. After trying something bold with the supersized and squared-off Passport, the Classic has a more, well, classic design. Essentially a larger Bold 9900, the Classic has the traditional rounded edges, black face and silver sides of almost all BlackBerry phones from the past five years.

Like BlackBerrys before it, the Classic is a solidly built device, with a stainless steel frame, Gorilla Glass 3-protected display and a rubbery back that keeps the phone from slipping.

Below the display is a row of buttons (End, Menu, Back, and Call), which is bisected by the Classic's touchpad. Beneath is the iconic BlackBerry keyboard. On the top of the device is a 3.5mm headphone jack and a power button. The right side has volume controls and a button to launch BlackBerry Assistant, while the left side has a nanoSIM and a microSD card slot.

Weighing 6.24 ounces, the Classic is a heavy phone. By comparison, the Droid Turbo (6 ounce), HTC One M8 (5.6 ounces) and Galaxy Note Edge (6.1 ounces) are all lighter. Still, its weight didn't bother me all that much, even when typing. By comparison, the size of the 6.9-ounce BlackBerry Passport is as unwieldy as its weight.

Keyboard and Trackpad

It wouldn't -- it shouldn't -- be a BlackBerry without a physical keyboard. Fortunately, the keyboard on the Classic is a winner. While not curved like previous devices, the four straight rows of keys proved just as comfortable, and the angled surface of each made it easy for me to peck out emails and URLs.

The Trackpad, too, performed reliably. It was a cinch to scroll through email, select words and sentences, and move around the interface as a whole.

Display

At 3.5 inches, the Classic's LCD touch screen is 60 percent larger than the Bold 9900's 2.8-inch display, but bigger isn't always better. Its resolution of 720 x 720 pixels feels dated in an era of full HD and quad HD displays. The Passport, for instance, is just an inch larger but has twice as many pixels (1440 x 1440).

MORE: 10 Smartphones with the Longest Battery Life

Registering 368 nits of brightness, the Classic is on a par with the smartphone average (367 nits), but well below the iPhone 6 (504 nits), as well as the Samsung Galaxy S5 Active (490 nits). The Classic was able to show 105.2 percent of the sRGB gamut, and was reasonably accurate, with a Delta-E score of 4.9 (closer to 0 is better).

As with the Passport, the Classic's square screen means that, whenever you watch a movie or TV show, there will be black bars on the top and lower third of the display.

Trailers for Star Wars: The Force Awakens and Terminator: Genisys looked very good on the Classic, but with so much black space on either side, it wasn't as immersive as on a rectangular display. However, I appreciated the screen's dimensions when reading emails and documents. That's the price of doing business.

BlackBerry OS

The Classic runs the latest version of BlackBerry's mobile operating system, OS 10.3.1. As with Android and iOS before it, the Classic's software has a flatter look, with brighter colors and fewer shadows.

Along the left side of the lock screen are icons for the messaging services installed; a number next to each icon shows how many unread messages you have in each. Tapping one of the icons shows more detail about those unread items in the main part of the display. Tapping that detail then opens the message in its respective app. It's a great way to quickly read and respond to what's important.

After unlocking the Classic, the far left screen is known as the Hub; at the top, it displays upcoming events such as calendar invites and birthdays, and below is a universal inbox for all your messages, be they from email, Facebook, or whatever account you have connected to the Classic.

Swipe from right to left, and you get all the other home screens; the first is populated with thumbnails of open apps, and all others show apps installed on the device. Lest you forget that messaging is at the core of BB 10, a small icon in the lower left will quickly get you back to the hub.

When you have an app open, swiping up from the bottom of the screen minimizes the app to what BlackBerry calls an Active Frame, which you can then close by pressing a small X in the lower right corner of the thumbnail. You can have up to eight Active Frames open at any time.

Swiping down from the top of the display opens a drop-down menu, where you can access Wi-Fi, notifications and Bluetooth, among other settings.

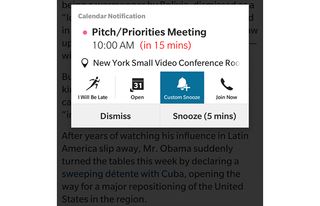

I especially liked notifications. If a meeting was coming up, an alert let me dismiss, snooze, join the meeting (via a phone call), or send a message telling the participants I was running late.

Overall, the interface makes sense given BlackBerry's philosophy, but there is a learning curve over the simpler interfaces of iOS and Android.

Universal Search

Take that, Spotlight. From the Classic's home screen, if you start typing anything, a bar will appear at the top of the screen with your search term, and results will show up almost instantaneously. Results are divided into categories, such as Contacts, Calendar, Messages and Apps. It's a great way to find whatever it is you're looking for.

BlackBerry Assistant

While the Classic has an excellent keyboard, the voice-command BlackBerry Assistant is so useful, you may not need to use your fingers at all. Pressing the button between the volume controls launches BlackBerry Assistant, the company's response to Siri and Google Now.

"Send an email to Mike Prospero" launched the mail app. The Assistant then walked me through the entire process, asking if I wanted to add additional recipients, what I wanted the subject to be, and what the message should say. After I dictated my responses, it asked me if I wanted to send the message. The only thing I couldn't do was add an attachment using just my voice.

MORE: Best Smartphones on the Market Now

A spoken request for "directions to Yankee Stadium" was returned immediately, and the Classic opened up the Map app to show me the way. (No, Maps doesn't include transit or walking directions.)

You have to be a little patient with BlackBerry Assistant; after it asks you a question, you have to pause for a second to respond, or else it won't hear your request.

Security

One of the reasons for BlackBerry's longevity is its excellent security features. This tradition continues on the Classic, including 256-bit AES encryption, home-screen locks, and BlackBerry Protect. The latter lets you locate your missing phone or display a message on its face to have whoever finds it call you back. You can also remotely wipe or lock the Classic.

Given its appearance on both Apple and Samsung smartphones, however, I'm a bit surprised that BlackBerry has yet to include fingerprint ID on its devices.

BlackBerry Blend

Similar to Samsung Link, BlackBerry Blend allows you to access the contents of the Classic on your notebook via USB or over a Wi-Fi connection. The desktop client (available for Macs and PCs) is 122MB in size, and installs quickly.

The home screen shows, at the top, small cards for Email, BB Messenger, and SMS texts, your calendar in the middle, and thumbnails of other apps at the bottom. Selecting, say, email opens the app to fill the window, and gives you full access to your accounts.

I found Blend to be a simple and secure way to access all the content of the Classic on my notebook. It's most handy if you're traveling and don't have a wireless hotspot, but want to read and respond to email on your laptop instead of your smartphone. Then again, the Classic can also act as a wireless hotspot, which makes Blend feel a bit redundant.

Performance

Powered by a 1.5-GHz Qualcomm 8960 processor, the Classic was quick to open email, and navigating through the operating system was swift. However, it's not the best on the block.

BlackBerry claims that the Web browser on the Classic is one of the fastest, but that didn't hold true in our testing. On SunSpider, its score of 1426.8ms (shorter times are faster) was well behind the Samsung Galaxy S5 Active's 419.3ms. Even the older iPhone 5s was a much faster 436.5ms.

MORE: Best and Worst Smartphone Brands

The Classic's score of 2,919 in 3DMark Ice Storm Extreme was more than 10,000 points lower than the category average (14,972), the iPhone 5s (13,795) and the Samsung Galaxy S5 (18,204). I'm willing to give the BlackBerry a slight pass, as it had to run this test through Android, and not its native OS.

Apps

Crucially, the Classic's email app worked spectacularly. I often received emails on the phone a few seconds before they showed up in either my Gmail or Outlook inboxes on my computer.

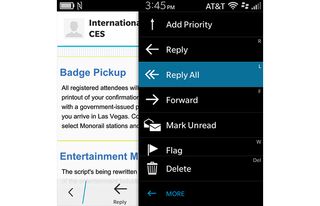

A swipe to the right from the Hub, and I could see messages sorted by app (BBM, Facebook, Gmail, etc). Selecting an email and pressing the BlackBerry button brought up a variety of options such as Reply, Forward, Flag and Delete.

The Classic comes preloaded with Documents to Go, Evernote, LinkedIn, FourSquare, Box and a somewhat basic Maps app.

The biggest failing of BlackBerry is its lack of app support. While Skype and Twitter both worked as well as their iOS counterparts, the ecosystem is missing such crucial productivity apps as Microsoft Office, not to mention all Google apps.

Not only is there a paucity of apps in BlackBerry World, but the ones that are there are a shadow of what you'll find on Android and iOS. ESPN's ScoreCenter app, for instance, doesn't show scores within the app; it takes you to the browser instead. The app also took so long to load any information, I gave up on it after a few minutes.

Yes, you can download apps from the Amazon App Store, but porting Android through another OS results in an imperfect experience. For one, installing the app is a longish three-step process. First, you have to press the Get button to download the app. Next, you have to press Install, then Accept for the security restrictions.

MORE: The Most Expensive Smartphones in the World

Every time I launched Minion Rush, it took more than 2 minutes to load. No thanks. Angry Birds: Star Wars clocked in at 25 seconds.

Once apps and games finally launched, they looked pretty good on the squared dimensions of the Classic's display. My Alfa Romeo in GT Racing 2, for example, zoomed smoothly around the track, although there was noticeable pixelation around the edges of the car.

Call Quality

Apart from typing email, the Classic also excels at phone calls. Over AT&T's network, a caller heard me very well, even with traffic all around. He complained only of slight hissing during pauses. On my end, it sounded as if he were standing next to me.

Camera

The rear 8-MP camera on the Classic took fairly good photos, but was often slow to focus. HDR mode did a good job of capturing an outdoor holiday market in the late afternoon; it was able to preserve the colors and details of the shoppers in the darker foreground, while still keeping the pale blue sky and Empire State Building at the proper exposure.

However, when using HDR mode, the camera takes several seconds to process the final image -- something that's instantaneous on the iPhone 6. Also, several times when I was using HDR mode, the screen would say "processing," followed by "image capture failed."

Camera features include several different scene modes, the aspect ratio of the image and HDR. One mode, Time Shift, is useful for group portraits. It takes several images in a row, and then lets you pick the best faces from separate shots and combine them.

After you shoot photos and videos, you can edit them via the Story Maker app, which lets you change brightness, color and contrast, among other things. An auto-creation feature will suggest edits based on the content.

The front 2-MP camera on the Classic proved very good for Skype calls. My colleague said he could see the stubble on my face, and my dark blue shirt popped.

On my end, the Classic's bottom-mounted speaker was loud enough for me to comfortably hear him from a few feet away.

Battery Life

You don't have to be a road warrior to appreciate great battery life. I made it through a day and a half using the Classic to read email, surf the Web and browse through Facebook, and watch a few trailers before needing to recharge its large 2,515 mAh battery.

If the Classic does start to run low, a Battery Saving Profile feature will automatically lower the display brightness, set the screen timeout to 30 seconds, and keep the screen off when notifications come in. You can also customize this feature to throttle the CPU and turn off data and location services. Additionally, you can set the threshold battery life for the profile to activate; by default, it's set to 20 percent.

Bottom Line

The BlackBerry Classic is like going to a Rolling Stones concert: you'll hear some good new stuff, but you're really there for the greatest hits. For BlackBerry diehards whose old 9900s are falling apart, the Classic will be a welcome upgrade. You get a familiar and comfortable physical keyboard, strong security and long battery life, plus new goodies like BlackBerry Assistant and a smarter hub. You can even run Android apps, even if the process is convoluted.

For those who migrated to Android or iOS, the Classic's physical keyboard will be tempting, but those folks have moved on to bigger and sharper screens and aren't looking back. The Classic is for those who want a little bit of the past and future in one device.

BlackBerry Classic Specs

| Bluetooth Type | 4.0 LE+EDR |

| Brand | Blackberry (RIM) |

| CPU | 1.5 GHz Qualcomm 8960 |

| Camera Resolution | 8 MP |

| Carrier | AT&T |

| Data | EDGE/GPRS/HSPA+/LTE |

| Display (main) | 3.5 inch LCD/720 x 720 |

| Display Resolution | 720x720 |

| Form Factor | Candy Bar |

| Front Camera Resolution | 2 MP |

| GPS | Yes |

| Internal Memory | 16GB |

| Memory Expansion Type | microSD Card |

| Networks | LTE (1,2,3,4,5,8,20), HSPA+ (850/900/1900/2100 MHz), GSM/GPRS/Edge (850/900/1800/1900 MHz) |

| OS Family | BlackBerry 10 |

| Operating System | BlackBerry 10.3 |

| Phone Display Size | 3.5 |

| Ports | microUSB, Nano SIM, 3.5mm headphone |

| Processor Family | Qualcomm Snapdragon MSM8960 |

| RAM | 2GB |

| Size | 5.15 x 2.85 x 0.4 inches |

| Weight | 6.24 ounces |

| Wi-Fi | 802.11b/g/n |